Harmonic patterns are vital tools for technical analysis, especially in predicting price movements in the financial markets. These patterns are utilized by traders to identify potential entry and exit points and forecast trend reversals for both short- and long-term profits. In the fast-paced world of Contract for Difference (CFD) trading, where traders speculate on price movements without owning assets, harmonic patterns offer an essential advantage.

By utilizing harmonic patterns, traders can anticipate where trends may reverse or continue. As the CFD market is fast-paced, these patterns help traders make swift decisions, where speed can be the deciding factor between profit and loss. Understanding these patterns, regardless of whether you’re a beginner or an experienced trader, is beneficial for enhancing trading strategies. This article will guide you through everything you need to know about harmonic patterns and how to maximize their use.

What Are Harmonic Patterns?

Harmonic patterns are geometric formations on price charts that follow specific Fibonacci ratios, enabling traders to forecast future market trends. These patterns form an integral part of advanced technical analysis and are used by traders of all experience levels. The three main components of harmonic patterns include:

- Geometric Structures: Harmonic patterns create distinct shapes that may resemble the letters M or W.

- Fibonacci Ratios: These patterns rely on key Fibonacci ratios such as 0.618 (Golden Ratio), 1.618, and others.

- Price Legs: Harmonic patterns consist of five points, labeled X, A, B, C, and D, which define the price swings or “legs” of the pattern.

These patterns are based on the theory that price movements follow symmetrical relationships according to Fibonacci ratios, which traders believe reflect the natural rhythm of markets, market psychology, and buyer/seller behavior. A key area within a harmonic pattern is the Potential Reversal Zone (PRZ), where multiple Fibonacci levels converge, signaling a high probability of price reversal. The pattern is considered complete when all the legs form, and traders typically look for entry points at the PRZ.

Common Harmonic Patterns

Several common harmonic patterns are used in different asset classes. Here are a few of the most popular ones:

Gartley Pattern

The Gartley pattern, named after H.M. Gartley, is one of the most well-known harmonic patterns and is known for its reliability. Key characteristics include:

- Forms an “M” shape in an uptrend or a “W” shape in a downtrend.

- Consists of five points: X, A, B, C, and D.

- The AB leg retraces 61.8% of XA.

- The BC leg retraces 38.2% to 88.6% of AB.

- The CD leg extends to 127.2% to 161.8% of BC.

This pattern is considered a continuation pattern. After the pattern completes at point D, the price is likely to continue in the direction of the XA leg.

Butterfly Pattern

Discovered by Bryce Gilmore, the butterfly pattern is a reversal pattern indicating a potential trend change. Its structure includes:

- Consists of five points: X, A, B, C, and D.

- The AB leg retraces 78.6% of XA.

- The BC leg retraces 38.2% to 88.6% of A.

- The CD leg extends to 127.2% to 161.8% of XA.

The butterfly pattern forms a deep “M” or “W” shape, and the final leg (CD) extends beyond point X. Traders often use this pattern in conjunction with key support or resistance levels for effective trade setups.

Bullish Bat Pattern

Developed by Scott Carney, the bullish bat pattern is used in an uptrend to find entry points before an uptrend continues. Its key elements include:

- XA is the initial upward move.

- AB retraces 38.2% to 50% of XA.

- BC retraces 38.2% to 88.6% of AB.

- CD extends to 161.8% of BC.

The bullish bat pattern is effective for entering long-term positions as the price approaches point D and signals a reversal.

Advanced Harmonic Patterns

Advanced harmonic patterns include variations like the crab, cypher, and XABCD patterns. These advanced structures enable traders to trade with greater precision and capitalize on price extensions and reversals. Key advanced patterns include:

- Crab Pattern: Known for extreme price extensions, this pattern is ideal for identifying exhaustion points and predicting sharp reversals.

- Cypher Pattern: A newer pattern that differs from traditional harmonic structures and is highly reliable in fast-moving markets.

- XABCD Pattern: A flexible framework for identifying custom harmonic structures in speculative markets.

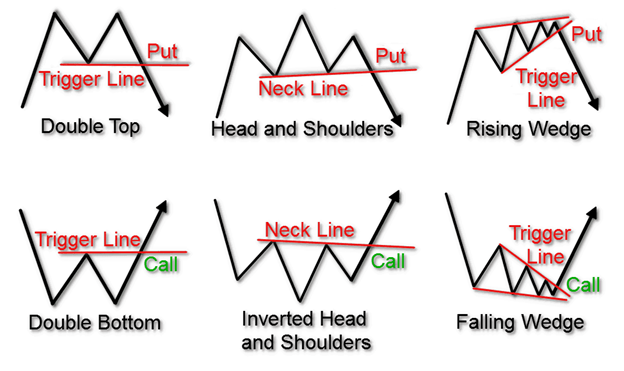

Bullish vs Bearish Patterns

Harmonic patterns can be either bullish or bearish. A bullish pattern signals a potential price reversal from a downtrend to an uptrend, while a bearish pattern indicates a reversal from an uptrend to a downtrend. Both patterns rely on the same Fibonacci principles and geometric structures but have different interpretations depending on market direction.

How to Use Harmonic Patterns in CFDs

Harmonic patterns can be highly effective in CFD trading, where traders speculate on price movements. By identifying key Fibonacci levels and the PRZ, traders can position themselves for high-probability setups. It is essential to use additional indicators and risk mitigation strategies, such as stop-loss orders, to improve trade accuracy and minimize potential losses.

Brokers and CFD Trading

While brokers provide platforms and tools for trading, they do not offer strategies or guarantees of success. It is the trader’s responsibility to interpret patterns and manage risks effectively. Successful trading involves using harmonic patterns alongside other technical analysis tools to identify opportunities and manage risk in leveraged markets.

FAQs About Harmonic Patterns

How Do I Identify Harmonic Patterns?

Traders can identify harmonic patterns by recognizing price swings based on Fibonacci levels. Tools like Fibonacci retracement and harmonic pattern recognition software can help pinpoint these patterns on charts.

What Tools Can I Use for Harmonic Pattern Analysis?

Some useful tools for harmonic pattern analysis include:

- TradingView

- HarmonicTrader Software

- Thinkorswim

- NinjaTrader

Conclusion

Harmonic patterns are crucial for technical analysis, providing traders with valuable insights into potential market reversals. While these patterns are effective, they should be combined with other tools and indicators to increase their accuracy. Traders, especially beginners, should practice on demo accounts before applying them with real capital.

Start your trading journey today with PFD Markets. Open a free live trading account to experience real-time market action, or refine your strategies risk-free with a demo account.