Monthly Archives: February 2025

Rheinmetall Stock Analysis: Future Growth Potential and Investment Opportunities

Written on February 27, 2025 at 9:31 am, by alexzhou

Why Rheinmetall Stocks Could Be Your Next Smart Investment Choice If you’re looking for a robust investment opportunity, particularly in the defense sector, look no further than Rheinmetall AG. With its innovative approach and strong market positioning, Rheinmetall has become a favorite among investors who want to tap into the growing defense market. As ofContinue Reading

Straddle vs Strangle Options Trading Strategies

Written on February 20, 2025 at 8:04 am, by alexzhou

Options are financial instruments that give traders the right to buy or sell a financial asset at a predetermined price within a specific time frame. These instruments offer a variety of strategies depending on the market outlook. Among the most popular strategies for trading volatility are the straddle and strangle, both designed to capitalize onContinue Reading

Harmonic Patterns: Advanced Charting Techniques for Traders

Written on February 20, 2025 at 7:41 am, by alexzhou

Harmonic patterns are vital tools for technical analysis, especially in predicting price movements in the financial markets. These patterns are utilized by traders to identify potential entry and exit points and forecast trend reversals for both short- and long-term profits. In the fast-paced world of Contract for Difference (CFD) trading, where traders speculate on priceContinue Reading

Mastering Candlestick Patterns for Trading Success

Written on February 20, 2025 at 7:29 am, by alexzhou

Candlestick patterns are fundamental tools in technical analysis, offering traders a visual representation of price movements in real-time. Originating from Japanese rice traders in the 18th century, these patterns have since become an essential method for analyzing market sentiment and predicting future price trends. Understanding these patterns provides traders with insight into market dynamics andContinue Reading

Exploring Inflation-Linked Bonds and Their Role in Inflation Protection

Written on February 20, 2025 at 7:08 am, by alexzhou

Inflation significantly impacts investors by diminishing the purchasing power of returns over time. This erosion can lower the real value of fixed-income investments, affecting long-term portfolio growth. Inflation-linked bonds offer an effective solution to combat this issue. These bonds are structured to protect portfolios from inflation’s adverse effects. Their principal value and interest paymentsContinue Reading

How to Own Stock Portions in Big Companies

Written on February 20, 2025 at 6:20 am, by alexzhou

In today’s ever-evolving financial world, fractional shares trading has revolutionized the way retail investors access high-value stocks. Previously, purchasing full shares of leading companies was out of reach for many, often costing hundreds or even thousands of dollars. This high entry point created a barrier for many investors, limiting their opportunities to diversify or participateContinue Reading

Understanding Asset Classes: Key Categories for Effective Investment Strategies

Written on February 20, 2025 at 6:06 am, by alexzhou

Asset classes are groups of financial investments with similar traits and market behaviors. They serve as fundamental categories for organizing investments, providing traders and investors a structured way to allocate assets based on their goals, risk profiles, and expected returns. The primary asset classes include equities, fixed-income securities, cash equivalents, real estate, commodities, and currencies.Continue Reading

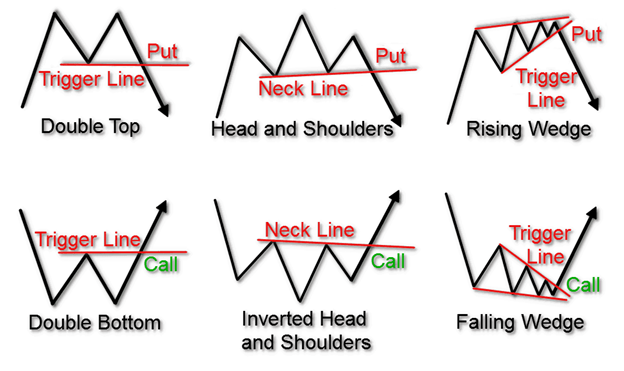

How to Identify and Leverage Market Reversal Candles

Written on February 20, 2025 at 5:56 am, by alexzhou

In the ever-changing landscape of financial markets, price movements rarely follow a straightforward path. Instead, they fluctuate in response to shifting economic factors, investor sentiment, and global events. Traders are often on the lookout for indicators that suggest a trend might be losing steam and ready to reverse. One valuable tool in this regard isContinue Reading

Triple Bottom Pattern: How to Spot and Profit from It

Written on February 20, 2025 at 5:46 am, by alexzhou

In financial markets, certain price movements follow predictable patterns that can provide valuable insights for traders. One such pattern, the triple bottom, is a key signal of a potential trend reversal, particularly from a bearish to a bullish phase. At its essence, the triple bottom pattern occurs when a market tests a key support levelContinue Reading

Understanding the P/E Ratio and Its Impact on Investment Decisions

Written on February 18, 2025 at 10:10 am, by alexzhou

The Price-to-Earnings (P/E) Ratio is an essential metric in stock market analysis. This ratio serves as a key indicator for comparing a company’s stock price to its earnings, offering investors insights into market expectations about its future growth. By comparing a company’s stock price to its earnings per share (EPS), the P/E ratio can helpContinue Reading